#Paypal invoice plus#

However, if requesting a check, you will be charged a $5 flat fee. PayPal fees are 1.9 to 3.5 of each transaction, plus a fixed fee of 5 cents to 49 cents. There is no fee to withdraw your PayPal account balance to your registered US bank account. If living outside the USA, please check your country's PayPal website to find more information about your PayPal invoicing fees. The fees are also different between invoicing a client living in your own country and an international client. PayPal fees are different from country to country. See monthly, quarterly and yearly sales trends at a glance.

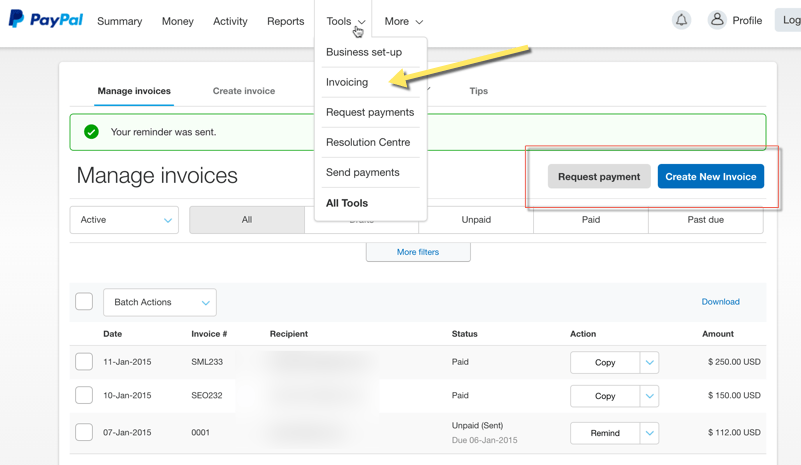

Accepting payments part 2: Sending invoices. Just enter the amount and share the invoice as a link without physical contact by text, email, or messaging app. Your customers can then pay with their preferred payment method. With the PayPal Business app for iPhone, you can: Make and send invoices quickly with an easy-to-use invoice maker. Take phone or in-person orders at a safe physical distance by sending a quick invoice on the PayPal Business app. Do PayPal fees vary depending on the country? PayPal will now generate an invoice and send an email notification to your customer. This integration with PayPal allows user to. More information is available on PayPal's website. A user can pay their invoice using our integrated Paypal functionality (it must be configured via the store). from your browser or trying a different browser/device. If working with an international client, you will pay a PayPal fee of 4.4% plus a fixed fee based on the country. It could be a technical glitch and such can be resolved by clearing your cookies, history, cache, etc. The cost of each payment received through PayPal is 2.9% plus US$0.30 for sales within the US. How much fees does PayPal charge per invoice?

0 kommentar(er)

0 kommentar(er)